Can You Sue Health Insurance for Negligence?:Imagine this: Your doctor orders an MRI for your chronic back pain. You double-check—your insurance plan covers it. But weeks later, you get a denial letter. “Not medically necessary,” they claim. You appeal, submitting detailed records. Still denied. Your pain worsens, and bills pile up. Frustrating, right? Now you’re wondering: Can you sue a health insurance company for negligence? Let’s break this down in plain English.

Health insurance helps us afford care. But sometimes, companies make harmful mistakes. Maybe they lose paperwork. Or ignore your doctor’s notes. Or delay decisions for months. When their errors hurt you, legal action might be an option. This guide explains your rights—without confusing jargon. We’ll use real examples and simple steps. You deserve fair treatment. Let’s get started!

What Is Negligence in Health Insurance?

Negligence means failing to act responsibly. Like texting while driving. For insurers, it’s about breaching their “duty of care” to you.

Examples:

- Losing claims repeatedly.

- Delaying decisions for months without reason.

- Ignoring evidence from your doctor.

- Misleading you about coverage rules.

Real-life case: Maria’s insurer “lost” her cancer treatment pre-approval request three times. Each delay set back her chemo. The court ruled this negligence caused harm.

Key takeaway: Not every denial is negligence. But repeated, unreasonable errors might be.

When Can You Sue Health Insurance for Negligence??

You can’t sue just because a claim is denied. But you might have a case if:

- The insurer broke its contract: Example: Your policy covers physical therapy, but they refuse payment without explanation.

- They acted in “bad faith”: Intentionally delaying, lying, or refusing to investigate.

- Negligence caused harm: Like Maria’s delayed chemo.

Jake’s story: His son needed emergency surgery. The insurer denied it, calling it “elective.” Jake appealed with hospital records. They still refused. His son’s condition worsened. Jake sued—and won. The court said the insurer ignored critical evidence.

⚖️ Pro Tip: Always keep denial letters, emails, and call logs. They’re evidence!

Steps to Take BEFORE Suing

Suing is expensive and stressful. Try these first:

- Appeal internally: Resubmit your claim with new evidence (doctor’s notes, studies). 80% of denials are reversed on appeal!

- File an external review: An independent third party decides. How to request one (external link).

- Report to your state: Every state has an insurance department. They investigate complaints for free. Find yours here.

Example: After Tom’s insurer denied his diabetes meds, he filed a complaint with the state. The insurer reversed its decision in 2 weeks!

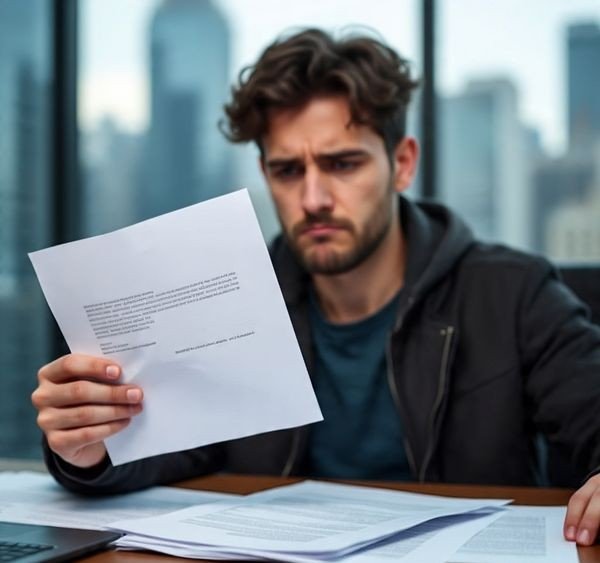

Building Your Case: What You’ll Need

If you sue, you must prove:

- The insurer owed you a duty (your policy contract).

- They failed that duty (negligence/bad faith).

- Their failure hurt you (worsened health, bankruptcy, etc.).

Gather:

- Your insurance policy

- All denial letters

- Medical records

- Proof of appeals

- Bills and financial losses

- Witness statements (e.g., your doctor)

📁 Document everything. Use a folder or digital tracker. Note dates, names, and outcomes.

What Happens During a Lawsuit?

Lawsuits follow steps:

- File a complaint: Your lawyer submits it to court.

- Discovery phase: Both sides share evidence.

- Negotiations: Many cases settle here.

- Trial (if needed): A judge/jury decides.

Fun fact: Most cases settle out of court. Insurers often pay to avoid bad publicity.

Timeline: Lawsuits take 1–3 years. Costs range from $10,000 to $100,000+ (paid by insurer if you win).

Alternatives to Lawsuits

Consider faster, cheaper options:

| Option | How It Works | Best For |

|---|---|---|

| Mediation | Neutral mediator helps you negotiate | Disputes under $50k |

| Arbitration | Arbitrator decides (like a mini-trial) | Complex cases |

| State Complaint | Insurance department investigates | All cases (free!) |

Success story: Lena used mediation when her insurer denied surgery. They settled in 30 days—no court needed!

What If You Win Your Case?

Compensation can include:

- Medical bills they should’ve paid

- Extra costs from delayed care

- Pain and suffering damages

- Punitive fines (if negligence was extreme)

Example: After winning her case, Maria’s insurer paid her chemo bills + $250k for emotional distress.

⚠️ Note: If you lose, you might owe the insurer’s legal fees. Always consult a lawyer first.

FAQ: Your Top Questions Answered

Q: Can you sue a health insurance company for negligence?

A: Yes, if their careless errors harmed you. But exhaust appeals and state complaints first. Lawsuits are a last resort.

Q: Which health insurance company denies the most claims?

A: UnitedHealthcare and Aetna often report high denial rates. But it varies yearly. Check your state’s insurance department for local data.

Q: How long do I have to sue?

A: Typically 2–4 years from the denial date (called “statute of limitations”). Ask a lawyer—deadlines vary by state.

Q: What’s “bad faith” vs. negligence?

A: Negligence is carelessness (e.g., losing forms). Bad faith is intentional harm (e.g., denying claims you know are valid). Bad faith cases often win bigger payouts.

Q: Do I need a lawyer?

A: Strongly recommended! Insurance laws are complex. Most lawyers work on contingency (you pay only if you win).

Wrapping It Up: Stay Calm and Fight Smart

So, can you sue a health insurance company for negligence? Yes—but only if they truly messed up and hurt you. Always start with appeals and state complaints. Sue only if those fail. Remember Maria, Jake, and Tom? They stood up for their rights. And you can too.

Your action plan:

- Read your policy.

- Document every interaction.

- Appeal every unfair denial.

- Report issues to your state.

- Consult a lawyer if you’re stuck.

Got a denial story? Share it below! 👇 Your experience helps others. And if you’re battling an insurer right now—don’t quit. You’ve got this!

Read More: Discover CenterWell Home Health: Care That Feels Like Home